Cash discounting, Cash Discount Processing Program, or simply put Cash Discount is a way for merchants to reduce some or all your merchant processing fees without increasing your overall prices. It is the legal way to discount which is different from credit card surcharges. It is a technique of implementing a service charge to all sales, while giving a discount to those who pay with cash. Those consumers who pay cash avoid the service charge that all other customers would see on their receipt. All other customers would see a line item added to their receipt. Our best Cash Discount Program merchant services payment processing technology allows this to happen and keeps you fully compliant with local government and state laws.

Discover MagicPay’s Cash Discount Program in the USA and know how to offset your credit card processing fees by offering consumers a cheaper way to pay. Credit Card Processing has never been so simple with MagicPay!

What is Cash Discount, Cash discounting, or Cash Discount Processing?

Eliminate 100% of Your Processing Fees

With our simple pricing model you can eliminate up to 100% of your merchant processing fees overnight.

Free EMV Terminal

WiFi, Ethernet or Dial-Up Connection

$20 Monthly Fee

24/7 Live Support

No Contract, Risk Free!

4% Service Fee Paid by Your Customers

Pricing

Simple and clear pricing suitable for retail, quick-service and restaurant based merchants.

$20 Monthly Fee

$0.05 AVS Fee (Address Verification Service)

$20 Chargeback / Retrieval Fee

4% Service Fee Paid By Your Customers

Free Dejavoo Z11 EMV Terminal

$0 Setup, Activation or Training Fee

$0 PCI Compliance Fee

$0 Cancellation Fee

$0 Batch / Settlement Fee

$0 Deployment and Shipping

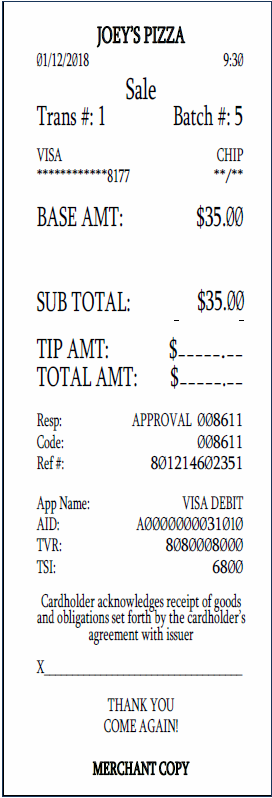

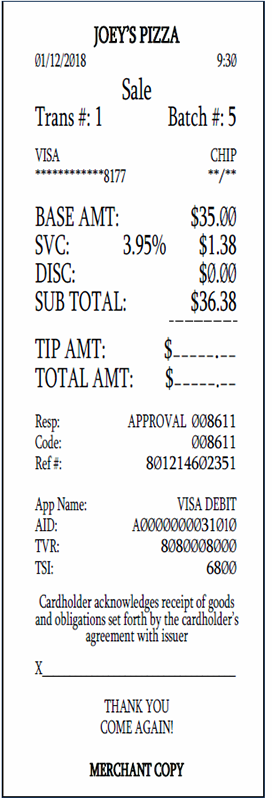

Sample Receipts

Below you can find examples of traditional receipts vs. cash discount program receipts.

Traditional Receipt

Cash Discount Program Receipt

Industry Compliance for Cash Discount Program or Cash Discount Processing Program

Merchant utilizing the Cash Discount Program are required to post a sign notifying their customers of the payment terms.

Merchants utilizing the Cash Discount Program or Cash Discount Processing Program are required to post a sign notifying their customers of the payment terms.

Merchants utilizing the Cash Discount Program are required to comply with industry guidelines. The guidelines of the Cash Discount Program are simple.

Post a sign on each point of entry to your store and at the cash register, notifying your customers that there will be a 4% service fee added to all purchases. Also mention that any customers paying with cash would be given a 4% discount instantly at the time of transaction.

You may use our template to post at your store. You can download the template in multiple formats below.

Frequently Asked Questions

Most common questions, answers and misconceptions about the Cash Discount Program or Cash Discount Processing Program are listed below for your convenience.

Is a Cash discount program legal in the USA?

Yes, a Cash discount program is legal in the whole USA and compliant with the law in all 50 states per the Durbin Amendment (part of the 2010 Dodd-Frank Law), which states that businesses are allowed to offer a discount to customers as an incentive for paying with cash.

Is the Cash Discount Program suitable for all business types?

This program is ideal for retail businesses with low ticket sales, since you are passing your merchant processing fees to your customer.

Is cash discount program some kind of new program?

Not really. In fact, this same method has been used by gas stations for quite some time, offering cash customers a discount. It has been around for some decades in Europe. Many national, local and government offices including the DMV, Secretary of State, Post Offices, Schools, Courts and the IRS implement a Service Fee.

What is Surcharges vs. Cash Discount Program?

A surcharge is an add-on fee on the price of goods and/or services. It is based on the percentage of the total price of goods and/or services before the taxes are determined or assessed. There are 10 States that do not allow surcharges and believe that surcharges are not fair towards consumers. These states are California, Colorado, Connecticut, Florida, Kansas, Massachusetts, New York, Oklahoma and Texas, plus the US territory of Puerto Rico.

Surcharge program has multiple restrictions:

- Only credit cards may be surcharged – not debit cards.

- Merchants must post a sign 30 days prior to implementing this program in their store notifying all customers.

- There is a 4% maximum that can be imposed.

- Surcharging is only allowed in some states (as mentioned above).

- With the cash discount program, these limitations above do not exist, as you are not implementing an additional fee for accepting credit cards, you are simply giving a discount to those customers who pay with cash.

On other hand, Cash Discount Program is allowed in all the 50 States including the US Virgin Islands. A Cash Discount happens when you offer a discount on cash purchases instead of credit card processing. The discount is basically a customer service fee. If you choose to pay with a Credit Card, then there will be a customer service fee. If you choose to pay with cash, then the customer service fee will not be charged.

Can I just implement this program myself?

When a fee is incorrectly applied to a particular transaction, any additional fee charged to customers using a credit card is labeled a Surcharge and that is not allowed by Visa, MasterCard and the payment processor without taking specific actions (see previous question above).

The way to solve this issue is to automate a Cash Discount Program, which is different from the Surcharge. In the cash discount program you must post signage notifying your customers that all transactions would incur a 4% service fee (with any form of payment), however, if you pay with cash, you will receive an automatic 4% discount on your purchase.

Additionally, you are forbidden by Visa, MasterCard and the Payment Processor’s terms and conditions to profit on a credit card transaction, which could happen if you mistakenly charged more than you were being charged by your processor. By utilizing the Cash Discount program, we establish a proper and compliant pricing program for you to ensure you stay fully compliant with all industry guidelines.

Will my customers be upset paying this additional service fee?

While nobody likes to pay extra for anything, many consumers are starting to realize how expensive it is to process credit card transactions these days. By charging a 4% fee on a sales transaction, that’s a small price to pay for the goods and services you sell.

In fact, industry surveys have shown that over 80% of respondent stated they would not think twice about paying such a fee, simply for the convenience of paying with a credit card vs carrying cash with them at all times. This survey was made on a $1 to $25 transaction amount.

Additionally, we’ve all got used to paying a $2 – $5 service fee when using an ATM machine, and this cash discount program is usually cheaper than paying this fee in most transactions.

If you explain your customers that the Cash Discount program is a way for you to keep providing quality products and services without increasing all your prices, most customers would understand and be OK with it. Lastly, usually a 4% fee on an individual transaction is a small price to pay for a consumer, however, for you the merchant, these savings build up.

What happens if I decide this program is not for me after I sign up?

If for any reason you wish to discontinue using the cash-discount program, you may be switched back to regular interchange pricing. Our terminals support both programs and can remotely be programmed for you.

Lastly, keep in mind that you do not sign any long-term contract with us, and you may cancel your account at any time without paying any penalties.