Costco Payment Processing? Terrible Mistake!

Hello Everyone,

Before I start telling my story I wanted to give a short background about myself. My name is Rami, I am a college student at Florida Atlantic University, pursuing my bachelor’s degree in accounting. I have been in the merchant services industry for about 4 years now and have seen plenty of bait-and-switch ads, false ads and a variety of other unethical business practices for the sole purpose of recruiting new clients.

What I am about to share with you is a severe case of unethical business practice that is being committed by one of the most reputable and credible retailers in America, Costco Wholesale.

Over the years Costco has enrolled in many different services. Aside from selling general merchandise such as food, accessories and electronics, for those of you that ever shopped in Costco, you would find kiosks such as major phone providers, local air conditioning companies, tile and other home improvement services.

One of the services Costco offers is Payment Processing. Costco has partnered with Elavon to sell merchant services to business owners in the United States. For those of you that own a business, you are probably very familiar with merchant services and credit card processing companies that are trying to sell you their service at the “best rate”. Since most merchant providers only compete on price, some companies have become very creative over the years as to the different kinds of pricing structures that are made just to confuse merchants and pretend to offer an extremely low rate, while in reality the fees and rates exceed the quoted price.

So after a long overview, I think it’s time to get to the bottom of this article.

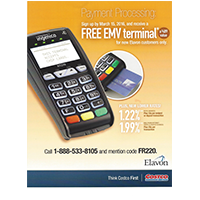

On February 24, 2016 I walked to shop in one of the South Florida Costco locations. As I am going through the main entrance there was one stand that caught my attention. “Payment Processing” printed in large thin letters and “FREE EMV terminal” in bulky thick font. So I started reading.

On the front of the flyer (see below) there was a picture of the famous, reliable and affordable credit card terminal, Ingenico Ict220. The Ict220 is a very popular credit card machine among merchant providers because it is cheap, user friendly and very reliable. Next to the image there was the prints “a $489 value”. Now, call me strict, but this terminal is valued at $190 at most. Small lie, might not harm anyone, but I kept reading.

PLUS, NEW LOWER RATES!

For those of you that know anything about interchange, you would know that interchange is NON-NEGOTIABLE. No matter how big or small your company is, everyone pays the same interchange. Interchange could be as low as 0.05% + $0.21 per transaction on regulated debit cards, and can be as high as 2.95% + $0.10 on some credit cards. On top of that Interchange is public information, just google it. (ex. Visa interchange)

The more points / rewards a customer is getting on their credit card, the more the interchange a merchant needs to pay for the acceptance of the card.

So how can huge Costco advertise 1.22% for swiped rates? Read the fine prints!

Quote from the fine prints on the back of the flyer: “Rates listed are for qualified transactions”.

WHAT IS QUALIFIED TRANSACTION?!

Fact: Tiered Pricing (Also known as “qualified”, “mid-qualified”, “non-qualified”) was structured to present rates easily to merchants, but in reality, the merchant provider themselves chooses which cards are qualified or not.

Result: while your “qualified” rate may be 1.22%, your non-qualified rate may be over 3.5%.

FREE EMV TERMINAL? NOT REALLY.

“To qualify for this special offer, business must be a Costco member and a new Elavon customer… Must actively process payments for 6 months following account activation with a minimum of $3,000 over the same 6-month period or a $489 charge will be debited from the member’s processing account”.

Did Costco just say that it will penalize small merchants for not processing enough? YES! Basically if your small business does not hit the $3,000 minimum they will charge your account $489, which is their so-called “free terminal program”.

HOLD ON, IT GETS EVEN WORSE!

If I have not persuaded you by now that Costco is misleading merchants on their payment processing services, I urge you to read the next quote taken directly, word-for-word, from the small prints of the flyer below.

“Rates and fees may change without notice. Rates and acceptance are subject to underwriting.”

So basically, this sentence voids every single rate/price/quote mentioned on the flyer since Costco can change the rate at any given time, without notice.

CONCLUSION:

The reason for me writing this article is not to get publicity on Costco’s expense, it’s not to get business and acquire new clients (although I wouldn’t mind it). The reason is because by Costco’s unethical advertising practices for payment processing services, the smaller and honest companies are getting hurt, and let me explain;

If a Costco member sees this ad, and believes it, after all, Costco is one of the largest retailers in America, with a credible reputation and years of experience. He or she would assume that the rates are truly that low and when an honest credit card processing agent will quote the customer at a true, higher cost, it would lose the business to the retailer giant, Costco.

Also, free EMV terminal programs are offered by plenty of merchant providers, without the limitations, the fine prints or the false claims. Merchant services is not a service that can be handled by every big company. Merchant services requires education about the industry and understanding of the hierarchy of payment processing. Giving Costco Wholesale do your merchant services is like giving your personal banker DJ (Disc Jockey) your wedding. There is no correlation between the two…

If you ask me, I doubt that Costco officials are actually aware of the unethical practice, but it shows a lack of internal control inside the organization. If you have any questions or comments about this article of about general merchant services questions, please feel free to contact me.