How Can Your Business Benefit From Mobile Payments?

How Can Your Business Benefit From Mobile Payments?

Most small and medium size businesses look beyond their capabilities in order to compete with their biggest and strongest competitors. As there are several ways they can adopt to accomplish that, varying from product differentiation to merchandise quality to customer service, in today’s market customer service has become an important subject as companies attempt to build trust and a long term relationship with their clients, resulting in satisfied and returning customers.

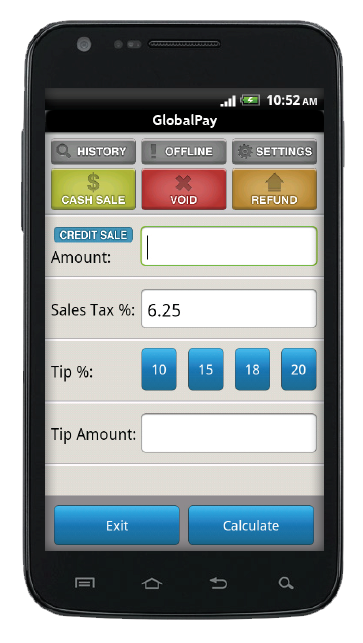

In recent years we have been watching how smartphones and tablets are developed and how technology innovation changes the rules of the game in business. In order to comply with the fast pace world that we are in, credit card processing firms have developed the ability to let mobile merchants accept credit cards where ever business takes them by using their smartphone or tablets.

Mobile payments can improve customer service by offering a convenient approach for on-the-go merchants to accept credit cards. Small businesses can benefit from a mobile payment solution as today’s world is working on a faster pace and consumers are constantly looking for faster ways to make a purchase without spending unnecessary time. Studies have shown that mobile payments reached $171.5 billion in 2012. Many small businesses can benefit from this figure, and your business could be one of them.

Accepting credit cards is been proven to increase revenue as most people that see the Visa, MasterCard, American Express or Discover logo believe that the specific business can be trusted. Also, clients tend to spend more when using credit cards as they can pay their debt in increments to the credit card issuer. The benefit that the mobile payment solution has over a traditional credit card machine, aside from time consuming, is that when a merchant comes to the customer’s location and provides a service for them they will feel much more comfortable and confident if they see that the card is swiped rather than watching the merchant writing the credit card details on a piece of paper or read it to a representative over the phone which could potentially end up in the wrong hands.

Aside from the customer’s protection point of view, mobile payments bring a huge benefit to the merchant’s protection by having the ability to recognize if the card was approved or not at the same moment and not taking the risk that the card will be declined when you get to your credit card terminal at the office later in the day.

In conclusion, mobile payments can help improve your customer service and increase your revenue which leads to increased profits. Aside from that, accepting credit cards will help you build trust quicker among your customers, which leads to returning customers. Also, mobile payments provide great merchant protection by giving the seller or service provider the ability to see if a payment went through or not, without taking the risk of a returned check or insufficient funds.